ibas++ Income Tax Payable by individuals Correction

ibas++ income tax correction – Income Tax Payable by individuals Correction – Tax Amount

income tax – ibas++ Income Tax Payable by individuals Correction is now open in ibas++. SDO officer can change his income tax payable amount from ibas++. If you have paid overpayment or need to consolidation so you need not pay from your salary. or the due amount of income tax may be paid from salary.

The income tax increase or decrease can be done by ibas++ This process is easy to complete from a home office. An officer can add or remove his income tax from ibas++. He/she can remove income tax by inputting 0 in the payable amount.

You don’t need to talk to your accounts office to change your income tax payable amount. Income tax may be paid in less or more than you deposite or advance payment from your monthly salary. This month is perfect to pay my salary from ibas++.

Income Tax Payable by individuals Correction / Income tax correction from ibas++

Income tax year July to June / Changing income tax from ibas++ is instructed below

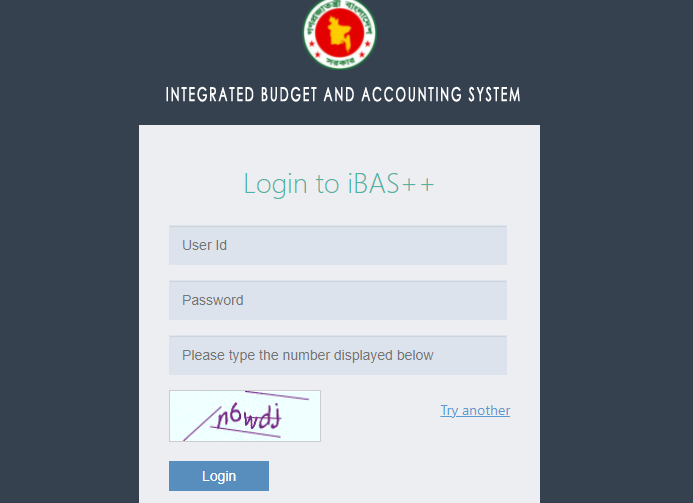

Caption: ibas++ Income Tax Payable by individuals Correction / Income Tax Payable by individuals

Income tax payable amount change in iBAS++

- Login to ibas++

- input user id and password

- Goto Budget execution

- Click bill submission

- Select Fiscal Year and Month of salary

- Click GO

- Click Settings from below

- Change income tax Payable by individuals Amount

- Click Save

- Done

Can we change Housing rent or Residential Telephone encashment allowance?

You, You can change income tax payable amount and also other options like house rent or Telephone encashment allowance – This three option can be used in this month named July. You can’t change these amounts anytime. GPF Correct option will be unavailable after this month. Use this option in this month only. For Staff, DDO will Change it.

https://bdservicerules.info/%e0%a6%8f%e0%a6%95%e0%a6%9c%e0%a6%a8-%e0%a6%b6%e0%a6%bf%e0%a6%95%e0%a7%8d%e0%a6%b7%e0%a6%95%e0%a7%87%e0%a6%b0-%e0%a6%86%e0%a7%9f-%e0%a6%8f%e0%a6%ac%e0%a6%82-%e0%a6%95%e0%a6%b0%e0%a6%a6%e0%a6%be/

https://bdservicerules.info/ibas-%E0%A6%B8%E0%A6%BE%E0%A6%87%E0%A6%9F-%E0%A6%A5%E0%A7%87%E2%80%8C%E0%A6%95%E0%A7%87-income-tax-statement-%E0%A6%B8%E0%A6%82%E0%A6%97%E0%A7%8D%E0%A6%B0%E0%A6%B9-%E0%A6%95%E0%A6%B0%E0%A6%AC/